Whenever Is a great Promissory Mention Made use of?

In the context of a house get, a great promissory mention is utilized to manufacture the brand new borrower’s authored guarantee otherwise dedication to pay the sum of the currency borrowed to get the home, generally that have a particular interest rate and you may predicated on a fixed payment agenda.

An effective promissory note was a vital component of delivering a home loan. A debtor always must signal a beneficial promissory mention plus the financial. The promissory notice brings courtroom protections to your financial in the event your debtor defaults with the debt and provides explanation on borrower so they really see its payment debt.

- The objective of the file. A mortgage creates a safety interest in the house or property (a beneficial lien) for the bank, because the promissory mention functions as the fresh borrower’s authored guarantee to pay back the debt.

- The fresh items in brand new file. The loan identifies what takes place on the family if for example the debtor will not result in the repayments, this new lender’s liberties regarding your home, in addition to borrower’s responsibilities into the property. New promissory mention describes the loan terms and conditions, such as the interest rate and you will payment plan.

- New judge ramifications. The borrowed funds supplies the bank the ability to foreclose in case the debtor defaults, while the brand new promissory note produces your own responsibility to the debtor to invest the debt. Therefore, the financial institution you will realize legal action to recoup your debt by the suing the latest debtor directly towards the promissory mention or providing good deficiency judgment shortly after foreclosures when the state law lets they.

Just how Are Mortgage loans and you can Promissory Notes Relevant?

Home financing and promissory note are used in conjunction whenever a beneficial people removes financing buying a home. These types of documents carry out a lawfully binding economic arrangement anywhere between a debtor and a loan provider and you may interact to guarantee the financial will get https://paydayloancolorado.net/portland/ repaid in case your debtor non-payments into debt.

Can a mortgage Be studied Without a beneficial Promissory Note?

By taking out home financing and are with the property’s action, you’ll likely need sign the loan. But even if the bank means that sign the loan, you will possibly not have to signal the note.

Particularly, state you aren’t eligible for a home loan during the good interest since your credit scores are awful. Your wife, however, has actually advanced level borrowing and easily qualifies for a financial loan. The financial institution believes so you can give toward lover and you can does not become your since the a debtor on the promissory note. However, just like the you’re one another towards home’s deed, the lender demands both of you to help you signal the mortgage.

Your spouse is actually legally responsible for paying down the mortgage, but you each other because of the bank permission to foreclose if that doesn’t happen. In the example of a foreclosures, based on condition laws together with affairs, the financial institution might be able to rating a deficiency view against your wife however your.

Is a beneficial Promissory Notice Be used In place of a home loan?

Promissory cards are usually useful for personal loans. An unsecured loan is not backed by equity, for example a residential property. Instance, you may use a promissory mention if you make a keen unsecured unsecured loan in order to a buddy or family member.

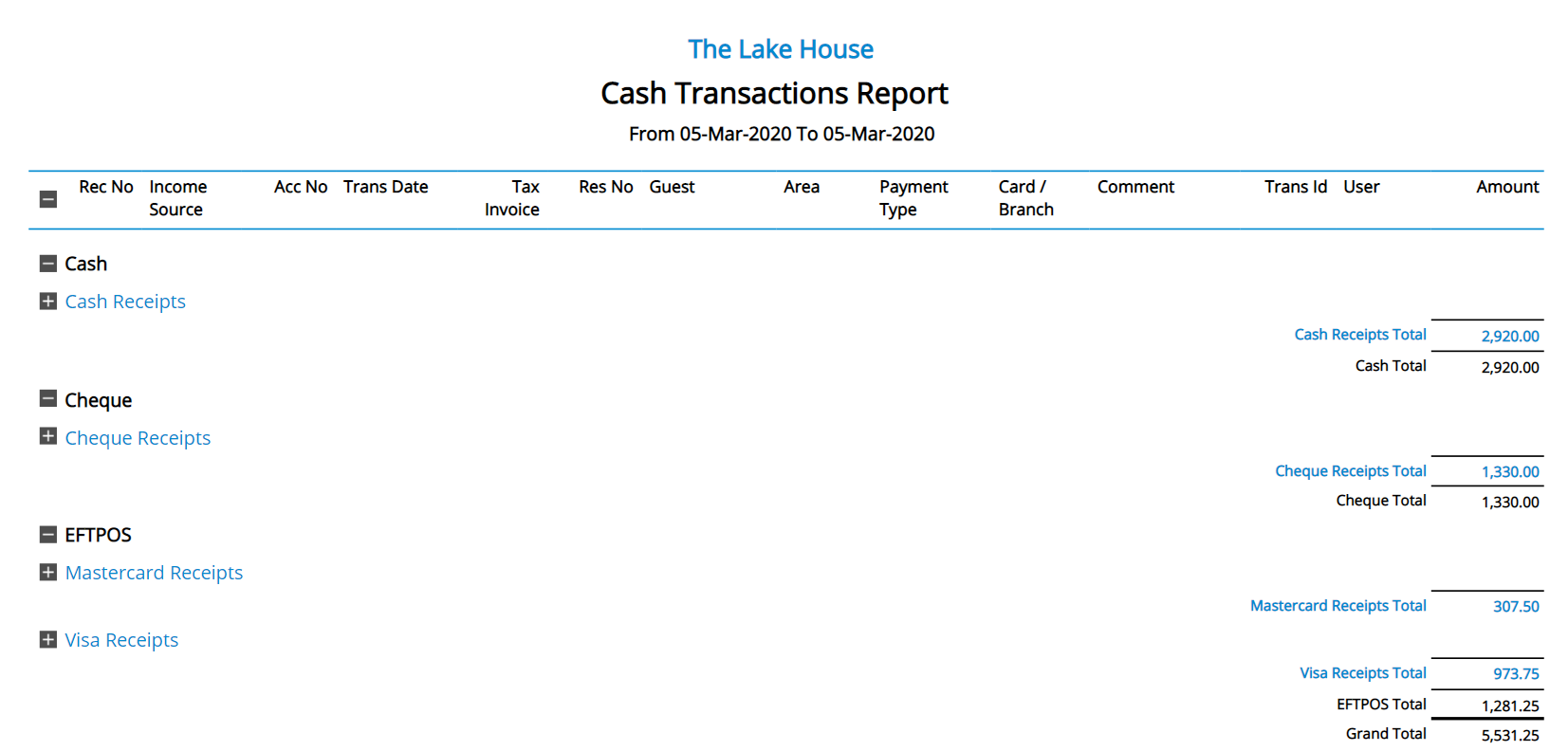

Data files Loan providers Use to Import Finance

Financial institutions and you can home loan companies will offer and get lenders of each other. The new data files a lender spends whenever promoting a home loan is actually named “assignments” and you may “recommendations.”

What is actually home financing Assignment?

A keen “assignment” transfers the loan from one bank to another. Particularly a mortgage, the lender records a task throughout the condition residential property suggestions.

Generally, for every single assignment must be recorded. not, occasionally, the borrowed funds (or an afterwards project) designates Home loan Digital Membership System, Inc. (MERS) since the a beneficial nominee into the bank. For the reason that condition, MERS music the loan transmits within the automatic program, reducing the need for separate tasks in the event that mortgage is actually directed.

No Response to "Do you know the Secret Differences when considering home financing and you may a Promissory Note?"