Therefore you happen to be finally taking the plunge you happen to be to get a home! If you find yourself like any younger folks from inside the Malaysia, you will want home financing while making one to get.

In a-sea away from lenders even offers, packages and you may adverts, it’s easy for a first-go out potential homeowner to be weighed down. Don’t be concerned, keep relaxed and study all of our comprehensive book towards home loans to slim their attention for the questions you should be asking.

What exactly is home financing?

You really already know just the response to which, exactly what would it be most? Its currency lent to you, brand new borrower, by the a loan provider, maybe a financial or other monetary intermediary (instance borrowing associations) allowed from the Bank Negara Malaysia and work out money. For the sake of ease, we’ll make use of the term bank’ to mention so you can an enthusiastic authorised financial.

The main is the number you are credit and that have to be reduced, in addition to desire (the bank’s finances getting loaning out loans for you) with the bank from inside the assured loan tenure (the amount of time given to your loan becoming settled).

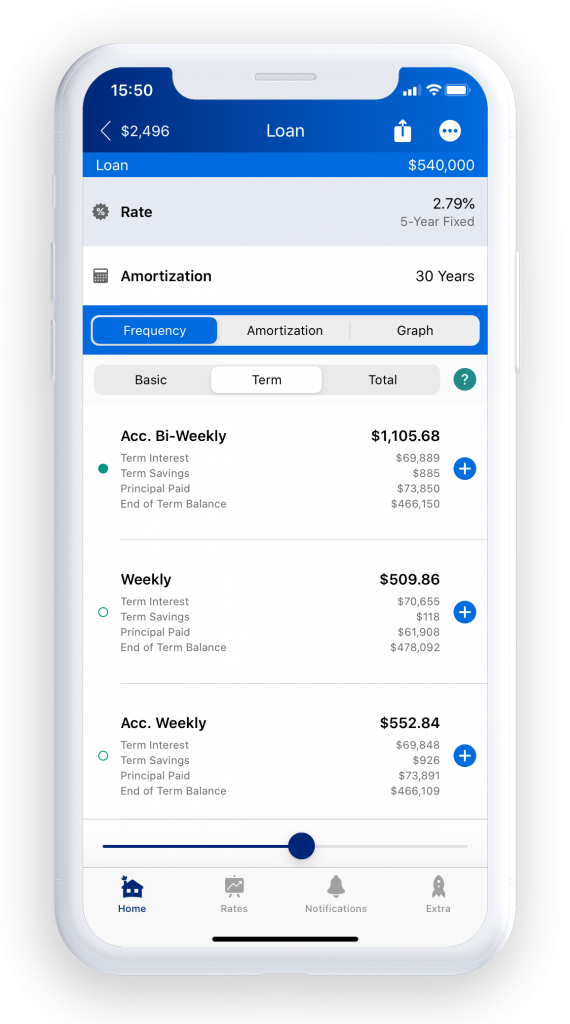

Mortgage tenures is maxed out on 3 decades (a little while thirty five years) or in the event the borrower reaches 65 years of age, whichever is reduced. Typically, offered loan tenures end in lower monthly loan repayments you to definitely sooner causes higher overall focus costs. Smaller financing tenures constantly indicate less need for complete but a higher monthly fees.

Exactly how is actually Interest rates Determined?

Interest is calculated with regards to how much they will cost you the lending company so you can mortgage you the funds need. Likewise, the possibility of consumers defaulting on their loans in addition to rate off rising cost of living across the mortgage tenure is additionally spent some time working on total interest.

Precisely what do Terminology Such BR’, ELR’ and Spread’ Suggest?

The cost so you’re able to loan away financing integrate a bottom Rate (BR) put because of the banks themselves and a spread you to definitely is short for the brand new bank’s debtor borrowing from the bank exposure, liquidity risk premium, doing work will cost you and you will an income margin. The brand new BR system is the new and is designed to do higher transparency; as well, it should could keep rates of interest aggressive.

If you see the text Active Lending Rate’ otherwise ELR, remember that simple fact is that amount of the BR and you will bank’s bequeath. Instance, assume that the brand new bank’s BR was at step three.20%, in addition to spread was at step 1.25%, this should indicate that new ELR on your home loan is actually cuatro.45%. This new ELR ‘s the interest youre paying with the top of the borrowed number.

The new BR, give and you will ELR are essential criteria you will want to work at that makes it possible to compare between finance companies to get an educated aggressive rates to suit your loan.

Choosing Mortgage Tenure of course, if mortgage loan is practical to you personally?

You really need to evaluate value, for instance, when you yourself have far more throw away money, you might choose to shell out more in monthly instalments and you may spend off of the mortgage reduced.

At exactly the same time, when you are balancing your earnings between some money and you will obligations, you could potentially americash loans Indian Field like a longer tenure and shell out less on the a month-to-month base.

Rates and you may financing tenure is actually interrelated as the prolonged their mortgage period, the more full attention prices are obtain.

Just how much Ought i Use?

Based on its margin off loans, a lender will usually mortgage out 80% to help you ninety% (particular even up so you can 95%) of your house’s price to help you a borrower. As a result you would have to shell out a down-payment of 10% to help you 20% of your own market value otherwise purchase price of the home. It is good if you possess the financing, but when you try not to, you can still find possibilities, including the My personal Basic Domestic Scheme, a federal government-centered direction system intended for enabling more youthful Malaysians pick its extremely very first home.

No Response to "What’s the Loan Tenure an average of in the Malaysia?"