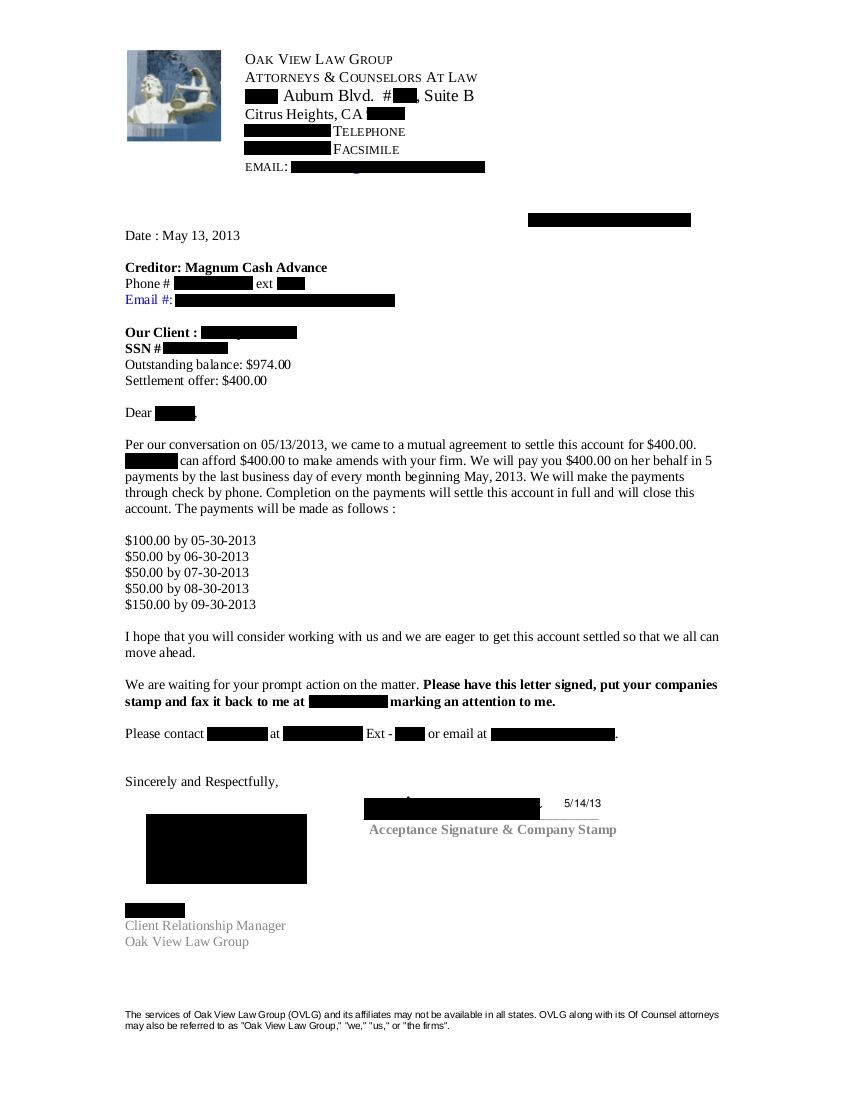

Within the last multiple ages, we’ve experienced the overall globalization out-of financial markets and, inside it, good liberalization inside mortgage markets in lots of Western regions.

Financial things around the world

Much of these types of deregulation work for the global financial areas – such as reducing limits on the explore and you may regards to financing and you may making it possible for a greater listing of loan providers to provide mortgage loans – have been made to foster a more payday loans Vona efficient around the globe program and you will discover the market so you’re able to the fresh new company, that have tabs on exciting lender battle, and thus decreasing individual can cost you. (more…)