Sustaining Loan Terms

Among the secret benefits of financial recasting is that you are able to keep their brand new loan terms unchanged. Through the use of a lump sum to lessen your financial equilibrium, the duration of your loan title remains the exact same. Such as, for those who first shielded a thirty-year home loan term, this can perhaps not alter following the a good recast.

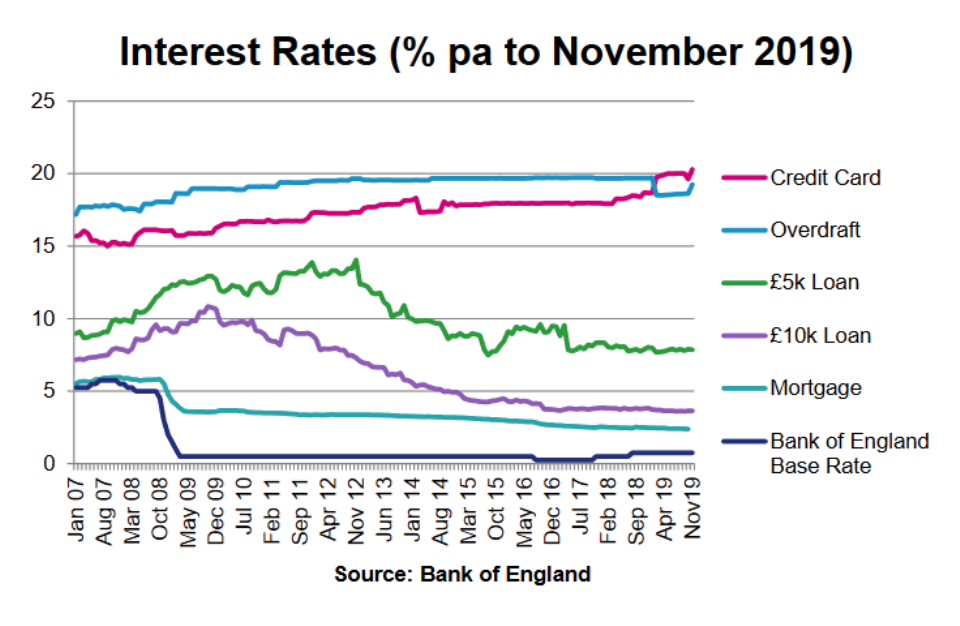

There’s no adjustment on the interest just after recasting-this time remains constant too. This proves particularly advantageous if you have prior to now shielded a nice-looking interest at the beginning of your own financial several months. Even though this lowers monthly installments because of a reduction in the principal balance, getting the benefit of preserving one to same good interest function structure and reliability try kept contained in this further mortgage repayments.

Monetary Freedom

Mortgage recasting offers substantial economic autonomy. Weighed against refinancing, and that necessitates trying to get another type of financing and you will incurring closing costs, the process of financial recasting was even less challenging. It involves a lot fewer documents criteria and does away with significance of a beneficial credit check, thereby ensuring that your credit rating remains unaffected of the choosing to recast the financial.

Any time you abruptly acquire most money-possibly regarding attempting to sell a special property otherwise receiving an inheritance-you could apply it windfall towards the reducing your month-to-month mortgage repayments using financial recasting. (more…)