Over the past long time, our homes and you may parents have become more critical so you can us than just actually. Many of us enjoys reassessed the life-style and you may goals. Maybe you’ve too, as they are today trying to make several home improvements, otherwise assist someone close whom needs it.

There is build this article to respond to particular faqs from the equity launch. Hopefully it assists you, however that it is merely a starting point. You can just take away equity release by way of a financial adviser, that will cam you as a result of such and every other inquiries in far more detail.

Simply how much could you discharge?

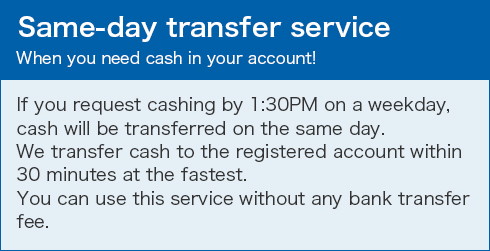

Shopping for guarantee launch? See how much you can discharge with these brief and you may simple to use collateral launch calculator.

Who’s eligible for security launch?

To discharge equity, you must be 55 or higher (or over fifty for our Commission Identity Life Home loan). As the collateral discharge concerns taking out fully that loan secured up against your own house, you always have to be located in it or in the newest procedure for to shop for it. Other loan providers usually apply other standards too. They are going to most likely view:

- How big your mortgage

- The value of your residence

- Whether it is a home, a condo, or perhaps a studio or bedsit

- What sort of position it’s inside the.

Some types of assets, including homes having personal liquids supplies, which have thatched roofs, with well over fifteen miles out-of basis otherwise with livestock, can be more complicated to discharge guarantee against.

Can i pay-off guarantee release early?

Yes by taking out a lifetime mortgage, a kind of equity discharge, you can pay-off some otherwise everything very early. However, lives mortgages was much time-term items, very that is not often your best option. You will most certainly have to pay an early on repayment charges (ERC), and is extremely high.

You might stop expenses an ERC less than particular situations. Such, if you’re swinging home, their lender you will allow you to import your lifetime financial into the new home without having to pay one. Or you might have the ability to created elective limited repayments ahead making repayments inside one to maximum.

Ought i remove equity discharge easily have a mortgage?

Sure, you can launch equity out of your home for those who have a great residential financial. But you’ll need to pay away from your mortgage and you can one early payment costs towards the money your launch.

I encourage examining your own home-based mortgage’s terms and conditions, or speaking really with your financial observe exactly how that could be right for you.

Could you take out security discharge over and over again?

Yes. By using aside a lifetime mortgage, you could potentially change it with a brand new one to. That is just like any other form of remortgaging. You could switch to get a lower rate of interest, acquire more cash, otherwise delight in most readily useful keeps and you will advantages. However, understand that you may have to shell out an early payment costs.

Just in case you begin because of the borrowing less than the most you may be qualified to receive, you might be capable borrow a whole lot more later. Instance, some loan providers and you can factors offer the substitute for obtain ?fifty,000, nevertheless only need ?10,000. So you could make the ?ten,000 now, up coming draw off more income later on, if the whenever you called for it.

Borrowing from the bank money as long as you’re happy to purchase it, will keep their financing costs off. However, keep in mind that rates of interest can alter, so you may obtain future amounts at different rates.

Do you really pull out collateral release into the a great leasehold property?

Yes, you could potentially release equity out-of a beneficial leasehold assets, in the event their financial will have to earn some monitors basic. Important aspects they are going to view include:

- How much time you have got kept on your own lease

- Any solution fees or ground rent you have to pay

- People probably tough conditions and terms on your rent

Are you willing to release security away from a contributed ownership property?

Sure, you could potentially discharge guarantee regarding a provided ownership property. Although count you could potentially discharge have to be sufficient to buy with the rest of assets, and that means you individual 100% of my website it on the completion of one’s financing. After which is complete, you happen to be liberated to purchase any extra currency although not you want.

Do equity launch apply to heredity tax?

For folks who render money to help you a family member or buddy, there is an inheritance tax responsibility for individuals who (and/or past surviving debtor) pass away within 7 years of making the current. The amount owed utilizes the length of time its because the provide was made together with size of the house. You can find out so much more in the:

Do i need to launch equity to pay off obligations?

Sure, you could discharge collateral to repay personal debt actually, it’s a quite common have fun with for this. You could pay off from a previous home loan otherwise an effective car finance to a charge card or a loved your obligations. Your agent will allow you to look at your choice, and make certain one equity release is considered the most pricing-efficient one. You can discover so much more within blog post ‘How so you can combine debt’.

How come security discharge apply at county positives?

Initiating collateral from your home won’t apply to your state Your retirement, it can affect other state benefits while you are acquiring all of them. Including Universal Borrowing from the bank, Council Taxation avoidance, Cold temperatures payments, also people assist you’re getting away from NHS and you may local council worry attributes.

What’s 2nd?

- Head to our very own guarantee discharge pointers centre

- Fool around with our equity discharge calculator to see exactly how much you can rating out of your home

- See if guarantee release suits you

So that as actually, all of our guarantee release advisers are ready and you can would love to answer one issues you’ve probably and you can cam you using our personal security release situations.

No Response to "Could you shell out taxation to the collateral launch?"