Daniel P Flynn

Whether or not you’ve receive the perfect household or you happen to be checking, reviewing available direction apps makes it possible to setting a technique for progressing.

Fixed- Price Mortgages: A fixed-price mortgage offers a normal rate of interest as long as you’ve got the mortgage, rather than a speed you to definitely adjusts or floats to your sector. A typical interest rate results in your own principle and you may appeal payment will remain uniform also.

Adjustable-rates Mortgage (ARM): An arm loan has an interest speed that stays the same getting a flat period of time, up coming alter so you’re able to a changeable speed that adjusts every year. Such, a eight/6 Sleeve has a basic interest rate for the earliest 7 age and then resets every six months then on the kept financing label.

Name Length: The duration of the mortgage commonly effect their payment per month. Such, the brand new smaller the mortgage identity, the more you might spend per month. As you talk about choices, consider carefully your down payment, the monthly budget and you will package appropriately.

Senior Domestic Credit Mentor

Fixed- Speed Mortgage loans: When you are fixed-rates money promote a reliable mortgage payment, they generally possess a higher interest. Since you weighing your options, you can also wonder, “So is this my personal permanently house, or simply just an area in which I am going to live for many decades?” That will help determine if a predetermined-rates mortgage suits you.

Adjustable-rates Mortgage: When you are you will likely spend a diminished interest rate within the basic months, your own commission could improve quite a bit if this months concludes-perhaps a lot of money thirty days. Speed limits limit the matter your own interest rate is rise, however, make sure you know very well what your own limit fee could well be.

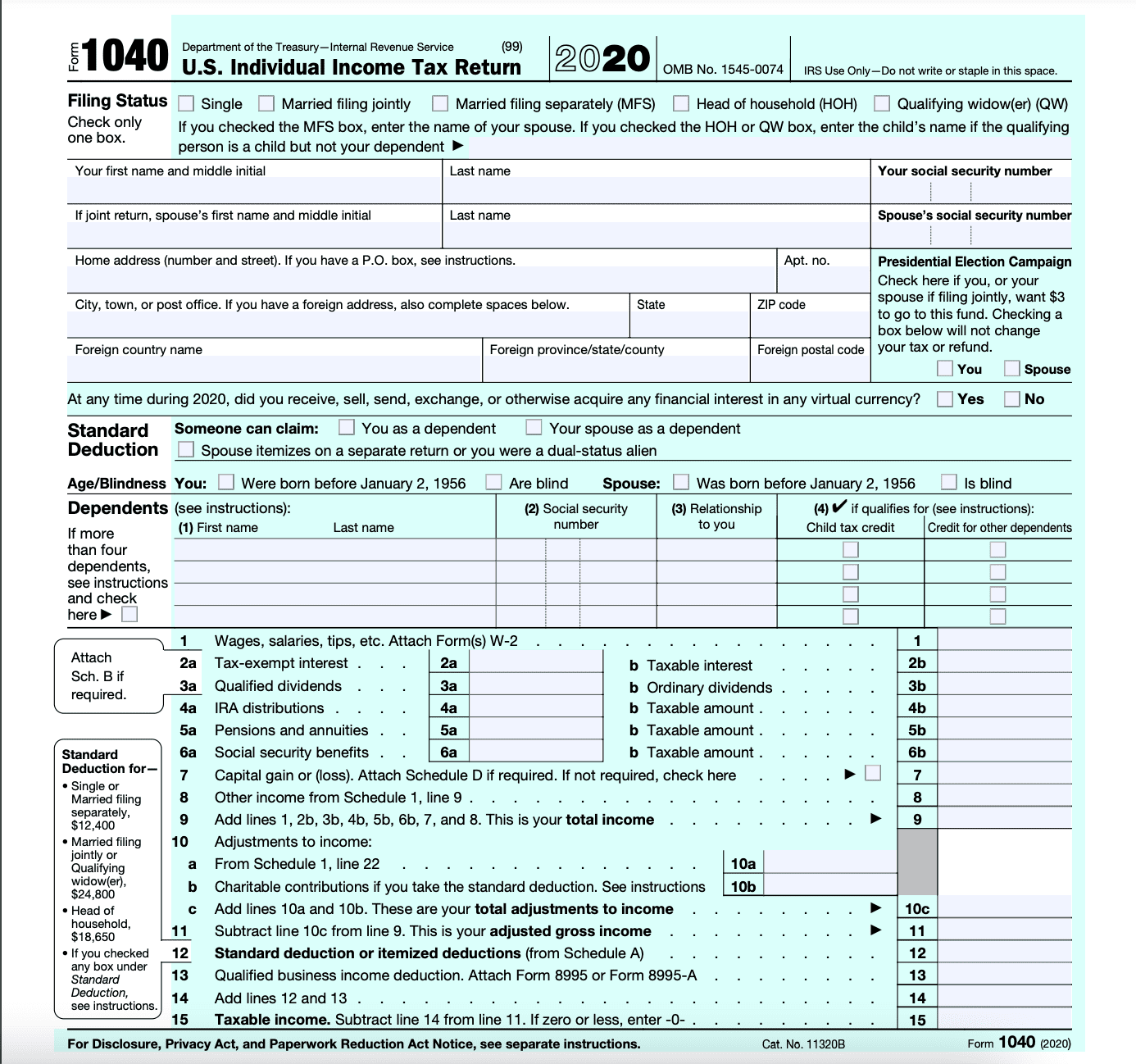

Their Personal Coverage count Pay stubs the past two months W-2 variations for the past a couple of years Lender statements for the past several months One or two several years of government taxation statements A signed price away from sale (if you’ve already selected your house) Details about current loans, along with auto loans, student education loans and you will credit cards

1. Gadgets and calculators are provided as the a courtesy so you’re able to imagine your own home loan means. Show shown try rates just. Consult with a great Pursue House Lending Coach for more particular advice. Content and you may studies costs will get pertain from the carrier.2. On the Varying-Rates Financial (ARM) unit, interest is restricted to have a-flat time frame, and you may changes sometimes after that. At the end of the fresh fixed-rates several months, the attention and you may money get improve based on upcoming directory costs. This new Apr can get improve adopting the mortgage closes.3. Money doing 85% of a house’s worth arrive for the a purchase or re-finance and no cash return, at the mercy of property type, a required lowest credit history and at least number of month-to-month supplies (i.age., you should kepted sufficient cash in set-aside and work out a great specified number of monthly home loan repayments dominant, focus, fees, insurance and you may assessments adopting the mortgage shuts). Unit constraints pertain. Jumbo funds readily available up to $9.5 billion. Getting financing number higher than $3MM (or $2MM to own resource services), consumers must satisfy blog post-closing resource requirements to meet the requirements. A lot more limitations get implement. Delight get in touch with a beneficial Chase Domestic Lending Mentor for details.cuatro. The DreaMaker home loan is just available for purchase no-cash-away re-finance out of a primary household 1-cuatro unit property to own 29-12 months repaired-rates words. Earnings constraints and homebuyer studies course is necessary when every mortgage candidates is first time homebuyers.5. FHA fund want an upwards-front mortgage advanced (UFMIP), which are funded, or paid on closing, and you can a keen FHA annual home loan insurance premium (MIP) paid off monthly will additionally implement.six. Veterans, Provider users who gets payday loans in Butler?, and you may members of the new National Guard otherwise Reserve is qualified for a loan secured by the U.S. Agency regarding Veteran Products (VA). A certificate out-of Qualifications (COE) about Va is needed to document qualification. Limits and you will limits use.7. An excellent preapproval is based on a review of income and you may resource advice your offer, your credit history and you can an automated underwriting system opinion. The brand new issuance from an effective preapproval page is not financing relationship otherwise a hope having loan recognition. We possibly may render financing relationship after you fill out an application and then we create a last underwriting comment, and verification of every suggestions given, possessions valuation and, in the event that relevant, buyer approval, that may end in a switch to the new terms of your own preapproval. Preapprovals aren’t available on all services will get expire shortly after 3 months. Get in touch with a house Lending Advisor to possess info.

This new NMLS ID try a different identity matter that’s given from the Nationwide Financial Licensing System and you will Registry (NMLS) to each Mortgage loan Founder (MLO)

JPMorgan Chase cannot promote taxation recommendations. Delight speak to your tax advisor regarding deductibility interesting and other charges.

No Response to "Explore the calculator having a detailed breakdown of your own monthly home loan will set you back"