Property became much more sensible than in the sooner point in time, because of the aggressive financing prices within the country. Also, elite lenders and other creditors keeps strengthened the convenience off the process of getting construction financing. Consequently, it generates request amongst affordable, average, and you may advanced portion consumers.

Getting the house try unarguably an amazing achievements and you will a good indication of balances and private gains. And you may, if you find yourself bringing an effective 40,000 salary in 30 days, practical question you truly must be enduring try, How much cash mortgage do i need to get on good 40,000 paycheck? There are a number of facts you to determine the loan count, and to know it far more directly, we’ll discuss the extremely important considerations and you will skillfully ideal procedures so you can see an amount borrowed effectively.

What’s the limitation amount borrowed having an excellent 40000 income?

The amount of the mortgage one could discovered having a month-to-month salary of ?forty,000 is purely influenced by certain affairs. A person has to complete all of the qualifications criteria, including the fresh CIBIL score, latest a job condition, productive mortgage throughout the borrower’s title, and mortgage period. Generally, lenders commonly choose a loans-to-earnings ratio code to determine the amount borrowed to have a particular applicant. And, income consideration is important because the lender identifies the brand new EMIs depending on your month-to-month income.

However, having a paycheck away from 40,000, one can possibly predict an amount borrowed varying ranging from ?20 and you can ?25 lakhs that have a period of approximately two decades at a great sensible interest rate. Seem to, these data will vary dependant on the fresh lender’s policies and can include things to look at while approving the mortgage application. It’s always best to comprehend the eligibility standards a loan provider keeps to follow along with, and you may smart considered is crucial to possess a mellow loan techniques.

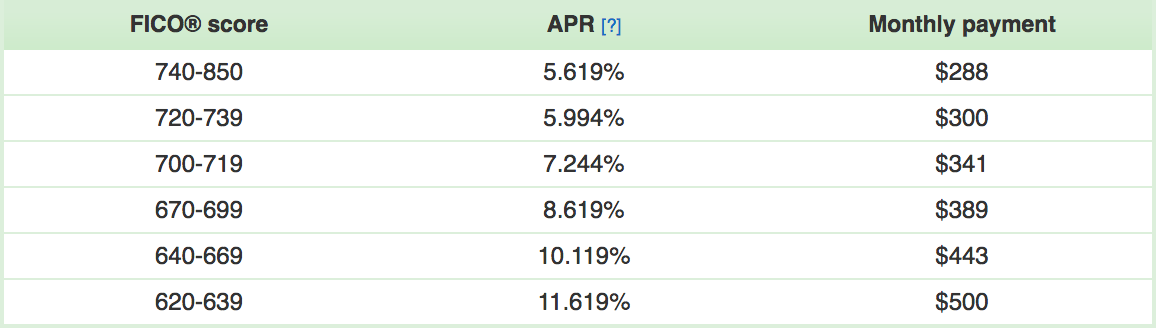

That have a salary away from Rs 40,000, we offer the next loan number out-of different finance companies:

Note: The second table brings a standard estimate and you will genuine qualification can get vary according to private points. Its necessary to consult with a lender to have accurate guidance.

How do i examine my personal financial qualifications?

The process of examining home loan qualification relates to numerous factors. This is the perfect assist you is choose follow to have a flaccid application for the loan:

- On the web Financing Calculators: If you find yourself selecting a reliable bank and you can going to the other sites, you really need to have seen a calculator available indeed there. Extremely creditors and you will finance companies render online home loan qualifications so you can succeed more comfortable for users to test everything you on their own. So, one can possibly need further strategies correctly.

- Assess your credit score: You should keep checking your credit score daily. With good CIBIL constantly positives you in several ways. As well as, it enhances your odds of taking a smooth mortgage procedure even on lack of any requisite documents.

- Get a financial Advisor: That have a monetary mentor with you will assist you to secure good loan amount. In addition to, he’s going to show you in making greatest upcoming financial intentions to be eligible for the mandatory mortgage.

File online personal loans MO Required for home financing

Records try a button planning, particularly when trying to get home financing. Data files assure a lender that candidate can perform and come up with the monthly EMIs and can repay extent according to the felt like tenure. I have simplified the menu of aren’t necessary data files lower than:

Title and you will Residential Facts: Speaking of a few very important data one cannot simply skip to get an excellent financial. You can consider appearing your own passport, driving license, ID cards, Aadhar card, etcetera.

Money Facts: Inspite of the income you’ll receive paid to your account, it usually is important to publish the income evidence. This can be needed to evaluate your capability to repay the borrowed funds. In addition to, if you find yourself good salaried candidate, the lending company otherwise bank commonly ask you to publish your own salary slips.

Assets Documents: With regards to home loans, possessions data, and additionally income plans, property income tax receipts, etc., is questioned becoming uploaded with the on the internet loan application.

No Response to "How much Financial do i need to log on to forty,000 income?"