Possessions requirements

And the borrower’s qualifications, the house or property need meet with the FHA’s minimum property conditions to invest in a foreclosed house with an FHA mortgage.

- Appraisal expected. Just before approving the loan, the new HUD often assign an FHA-recognized appraiser to examine the house. Not only can the appraiser assess the house’s value, however, they’re going to also point out any extreme destroy that would be something.

- Compatible condition. When your appraiser discovers criteria at home which will perspective a threat toward cover of renter or jeopardize the new soundness and you will build integrity of the home, more inspections or fixes is expected.

Financing restrictions

If you’ve found every other needs in the list above, then there is only 1 action kept: the dimensions of your loan. Annually, the HUD launches the brand new FHA mortgage floor and you may ceiling loan constraints.

- Flooring restrict. This is the minimum amount borrowed you might apply for. As of this seasons (2022), the minimum loan you can get is actually $420,680 having a-one-product property.

- Threshold restrict. As you may features thought, the brand new threshold restriction is the limitation amount borrowed you can implement having. Inside 2022, the roof to own a one-product home is $970,800.

Professional Suggestion

The process of making an application for an enthusiastic FHA financing is pretty similar to the way your make an application for other types of mortgage loans.

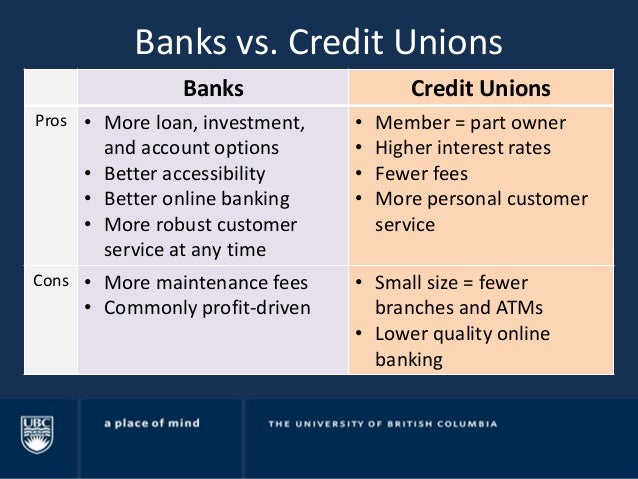

- Look for an enthusiastic FHA-accepted financial. Thank goodness that almost all banking institutions, borrowing unions, an internet-based loan providers provide FHA money, which means this shouldn’t be too difficult. As mortgage terminology may vary dramatically with regards to the financial, be sure to contact multiple FHA mortgage brokers and ask for a great price from each of them.

- Initiate your own financial application. Doing the application, loan providers usually typically need some crucial facts about your bank account. This could require you to render files showing you’ve got enough, steady, and you will renewable earnings. This type of data range from the current shell out stubs, W-dos versions, money earnings, lender statements, an such like.

- Contrast mortgage quotes. Immediately after you’re completed with the program, you need to next located that loan imagine on the lending company. Financing rates give important information regarding your monthly mortgage payments, the projected interest, as well as the complete settlement costs for the loan. Make sure to contrast financing prices off certain lenders prior to making the very last choice.

Settlement costs

The fresh closing costs of your own FHA mortgage are like people of a conventional loan. You will want to expect to pay as much as 2% so you’re able to 6% of total loan amount.

Eg, should your possessions you want to buy will set you back $five hundred,100000, you will have to spend any where from $10,100 to $31,100000 to summarize will cost you. So make sure you take this into account before purchasing a foreclosed house with an FHA financing.

If you’re looking getting a homes alternative that won’t crack the financial, a beneficial foreclosed domestic could be an effective choice. But not, be equipped for certain big legwork.

As a good foreclosed residence is reclaimed from the bank or regulators financial, a few of these services you want significant fixes. To possess domestic flippers, this is not problematic, however, brand new residents may want to avoid them.

Where are you willing to look for foreclosures available?

If you are searching to get loans Essex Village CT an excellent foreclosed domestic, you can look to own high excellent deals into the a residential property listing internet sites such as for instance Zillow.

There are also foreclosures for the HUD Domestic Shop. The latest land listed here are services which were acquired by the government due to foreclosure toward an FHA financial. You can look at the Freddie Mac’s HomeSteps and Fannie Mae’s HomePath for further posts.

No Response to "How to get pre-recognized having an FHA loan"