Significant growth along with the continuous innovation by technology entities introduces complex issues for accounting and financial reporting professionals. The technology industry has many rules that require tech companies to follow certain accounting methods, like accrual accounting. This approach to accounting means accountants for tech companies recognizing money earned and spent at the right times. Many tech businesses work with accounting firms that have access to well-established accounting practices. Public accounting is the field of accounting that deals with the financial statements and records of public, government, and non-profit organizations.

Enhancing Financial Insights with Software Development in Accounting

They usually need some education in accounting, but they also receive on-the-job training. Accountants work with other managers, reporting regularly on their companies’ financial status. They often assess financial performance and make improvement suggestions. Omni One offers both short-term and long-term staffing solutions to fit your business needs, providing only highly qualified candidates to immediately fill urgent vacancies. Omni One’s rigid screening process includes both personalized interviews and necessary background checks.

Utilizing Accounting Metrics for Financial Performance Analysis

As you go forward and grow, Freshbooks has excellent invoice software that will allow you to automate and simplify the invoice process. Tax advisory and compliance services aimed at maximizing available incentives and ensuring compliance with tax regulations specific to technology companies. Tax planning is crucial for tech startups in order to maximize deductions and credits, minimizing their tax liability. The careful management of taxes it’s also an important part of the accounting in startups.

What skills or expertise is required for high-paying accounting jobs?

Many accountants choose to become CPAs because the designation is considered the gold standard in the accounting profession. In the United States, certification requirements for accountants vary from state to state. But one requirement is universal—the passing of the Uniform Certified Public Accountant Examination. This exam is written and graded by the American Institute of Certified Public Accountants (AICPA). Accountants are required to meet state-specific educational and testing requirements and are certified by national professional associations. It’s wise to hire a person or invest in a system to help manage the accounting in your business.

- The exam is tailored to each state’s requirements and is administered by the state boards of accountancy.

- Chief financial officers lead corporate finance and accounting departments.

- Technology companies are facing stricter vendor requirements to reach their target customers.

- They may examine records in cases of suspected wrongdoing, or perform audits by request to ensure organizational financial records meet all regulations.

- Discover how you can acquire the most in-demand skills with our free report, and open the doors to a successful career.

- Building a scalable, robust financial infrastructure is a key part of building any business, particularly a high-growth tech company.

Technology and Emerging Growth Industry Challenges and Trends

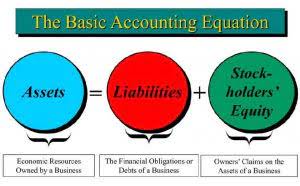

The specific services provided by Investment Consultants can vary, and their role may encompass a wide range of financial advisory services tailored to the unique needs of their clients. Today the modern accountant with an accounting degree plays a pivotal role in navigating the complex financial landscape of today’s business environment. Beyond traditional number-crunching tasks, these fine men and women now leverage advanced technologies such as artificial intelligence and automation to streamline processes, enhance accuracy, and provide valuable insights. These are the Generally Accepted Accounting Principles that are used to standardize accounting practice across the US. GAAP helps provide clear information on your business’s financial health. Quickbooks Online is another popular online accounting software providing users with the services they need to maintain a financially healthy business.

- An effective approach to accounting for tech companies takes a slightly different approach to that used by a more traditional business.

- Using accounting software can save a lot of time by doing tasks automatically, from calculating payable amounts to preparing reports.

- The average annual salary for a Chief Financial Officer in the US is $436,616 and is arguably one of the highest paying jobs in accounting.

- This perspective can be beneficial for professionals aiming to contribute to strategic decision-making within an organization.

Do startups use GAAP?

According to the department of labor statistics, employment of accountants and auditors is projected to grow 4% from 2022 to 2032, about as fast as the average for all occupations. They go on to say that about 126,500 openings for accountants and auditors are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. A Chartered Accountant (CA) is a professional accountant with a massive amount of knowledge of accounting who has earned a degree through a recognized professional accountancy body. One of the most important steps you need to take to set up your accounting system is to make sure that your files and documents are organized.

Employed by individuals or corporate clients, tax accountants prepare and submit tax documents. They make sure clients follow all relevant tax laws and maximize their deductions. Experts in labor policies, payroll accountants ensure that employee compensation adheres to government laws and regulations.

No Response to "Mastering Accounting for Tech Companies: The Ultimate Guide to Industry Accounting in the Technology Sector"