Take advantage of our very own Repaired Rates Mortgage, which have a fixed interest getting an appartment period, letting you plan your next with confidence. As a customer-owned financial, we have been serving all of our customers for over sixty ages. And our company is committed to offering back once again to people due to competitive costs and you may fairer costs. If you’re property client or homeowner trying to refinance, you will be wondering whether a changeable or fixed home loan rates is the greatest alternative.

A fixed home loan rate gives you the warranty that your particular payments will continue to be steady, in the place of movement in your interest levels, having a predetermined months usually anywhere between 1 and you can five years. We offer a number of home loan enjoys, so you can pay the ways we would like to. From our $0 lender fees therefore the choice to separated your property mortgage anywhere between a predetermined and you may changeable rate, you will observe why Aussies have picked out Qudos Lender for more than sixty age. In addition, our Repaired Speed Home loan offers the flexibility and work out additional payments around $ten,000 annually.

When comparing fixed home loan rates, it is critical to think about the relevant investigations rateparison rates make it easier to to determine the true price of the mortgage from the calculating the interest, along with certain charge and you can fees relating to the mortgage. Finance towards reduced fixed interest rate commonly constantly the cheapest solution. Be sure to comment brand new review speed to learn the actual cost of the mortgage unit you are obtaining.

Whats next?

As your software progresses, you’ll be leftover up to date with current email address announcements and calls from the faithful home loan specialist.

We’re a customers-owned lender

We are not on the stock-exchange and therefore we do not solution to dealers. Instead, our very own customers are all of our shareholders. Consequently we do not need to pay dividends and you may could possibly offer competitive pricing, fairer charges and you may reinvest on giving our people ideal services functions. By banking with our team, you will experience the difference between getting-profit and for-users.

Sophisticated customer care and extremely easy to talk to and ask inquiries. Smooth process animated home loan over and you will fixing rates. Expert reaction go out – very quick and easy to obtain a your hands on a real person. Strongly recommend.

Repaired Mortgage brokers Frequently asked questions

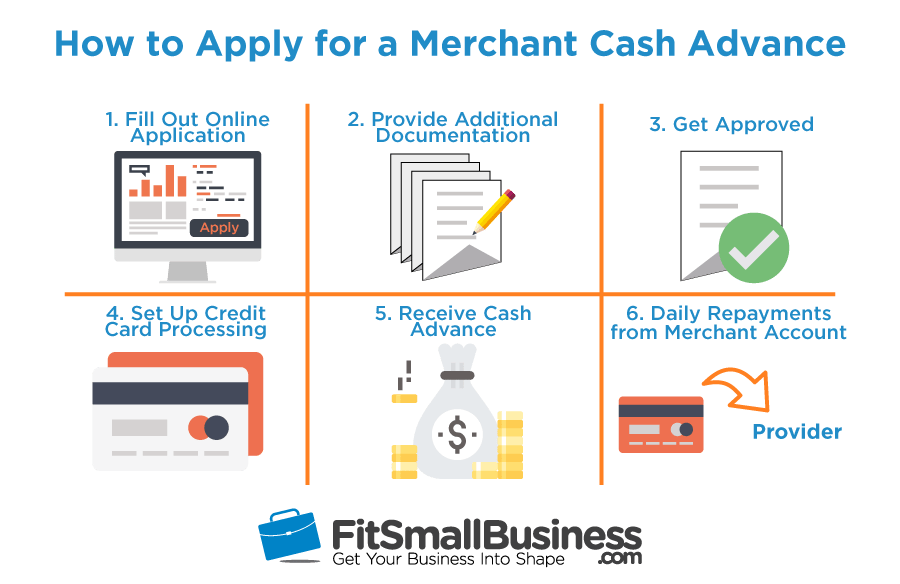

To try to get a mortgage with us, you can purchase in touch with the friendly class to procedure your application thru telephone, on the web or even in person in the one of the twigs. If you’re looking for a step-by-step publication on exactly how to sign up for home financing, up coming here are some our home Loan application Listing and you can Self-help guide to make it easier to from process https://cashadvancecompass.com/payday-loans-ia/portland. You can even here are some the house Application for the loan Techniques Page more resources for the home mortgage process

Online Apps: Once you have recorded the job and you may support pointers, conditional acceptance is often received inside 2 days, susceptible to high enough credit monitors and verification regarding economic and you can possessions advice.

Software over the telephone: After you have filed the application and you can supporting advice, conditional acceptance is sometimes acquired within 5 working days, susceptible to sufficient credit monitors and confirmation regarding financial and you may property suggestions.

Programs built in Branch: After you’ve submitted the application and you will help guidance, conditional acceptance is usually obtained within this 5 working days, susceptible to high enough credit monitors and you will verification out of economic and property suggestions.

Yes, you might separated your house loan ranging from repaired-rates and you can changeable-price things. We provide the choice on precisely how to split your property loan toward several profile round the more repaired and you may variable-price issues. This could make you better risk government and much more autonomy in and work out repayments.

No Response to "“Expert customer service and incredibly easy import out of home loan from other financial so you’re able to Qudos.”"