Share

Searching for a home loan would be stressful, even when the debtor knows just what a mortgage is and exactly how you to definitely really works. With the amount of lenders vying for their team, consumers can simply be overloaded because of the the alternatives. If a borrower is evaluating Quicken Finance against. Rocket Home loan, they shall be ready to remember that one another names refer to the brand new same company-which providers now offers a completely on the web financial process that helps make delivering that loan quick and easy.

Of a lot users question, Is Rocket Home loan a good? As exact respond to depends on the fresh borrower’s certain need, Rocket Mortgage is named one of the recommended mortgage brokers to own very first-date buyers and you will experienced consumers the same. The company’s easy on line mortgage techniques and total self-confident customers studies support the company’s dedication to making the home- lending techniques an easy one.

step one. Quicken Money and you can Skyrocket Home loan are the same company, however, one to was not always the case.

Whenever you are both Rocket Financial and you may Quicken Finance is actually identifiable brands from inside the the loan business, many people are not aware that they’re indeed one to in addition to exact same. Although not, the history of your own organization could possibly get a tiny confusing.

Rock Financial, a large financial company, are depending in the 1985 because of the Dan Gilbert and turned a home loan lender inside 1988. Gilbert’s purpose would be to explain the mortgage procedure having consumers-before internet sites is popular, so it created mailing financial data files so you’re able to users so that they could indication them home. But this Home loan inside a box was just the initial step toward a really simplistic mortgage processes.

When you look at the 1998, Gilbert emailed his staff outlining one his ultimate goal were to place the entire financial techniques on the web. Since sites was still putting on grip towards general people, it purpose almost certainly seemed like an extend during the time. However, Stone Financial first started concentrating on carrying this out purpose, and you may RockLoans introduced into the 1999-it was the start of the company’s electronic home loan business, built to bring a basic processes getting consumers. The following year, inside the December 1999, the business try purchased by Intuit and you may try rebranded since the hop over to the web site Quicken Funds. This acquisition is quick-resided, even though, once the Gilbert and lots of private buyers purchased Quicken Financing back of Intuit during the 2003, retaining the brand new advertising and purchases of the providers. Eventually afterwards, QuickenLoans premiered to greatly help give borrowers that have on line devices eg since the a payment calculator and online home loan app. By 2010, Quicken Financing designated a major milestone because of the closure the 1 millionth financing.

2. Quicken Finance released new Skyrocket Home loan brand name inside 2015 to manage its digital mortgage organization.

Due to the fact Quicken Loans’ digital financial organization proceeded to grow, the organization felt like they wanted to set a lot more of an interest thereon aspect of the business, and that lead to the development of Rocket Mortgage.

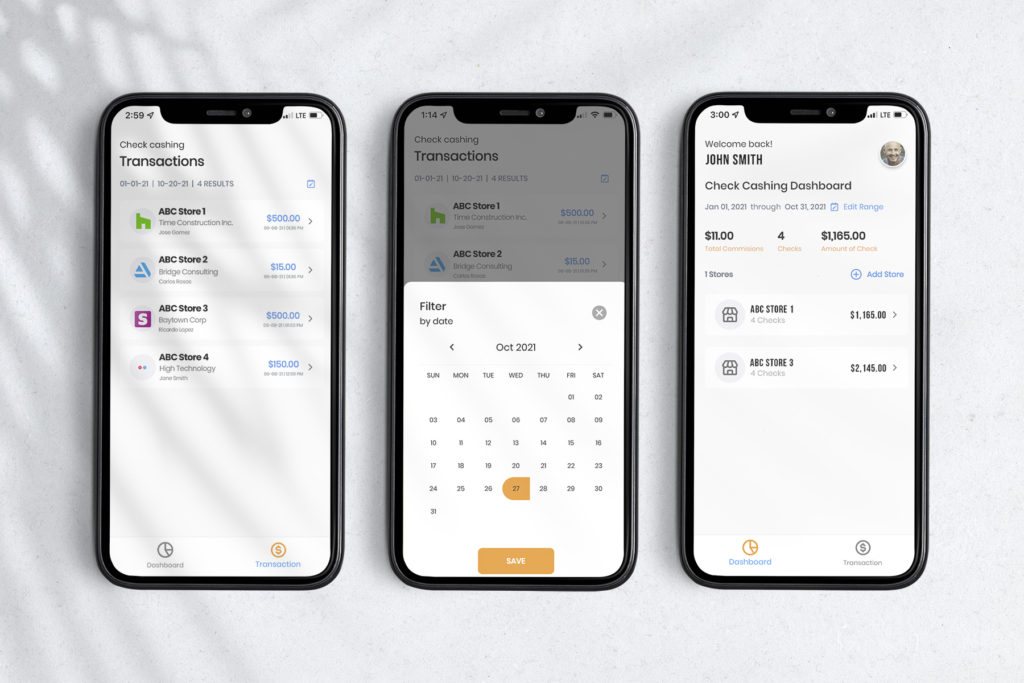

Rocket Mortgage was created inside 2015 because a part out of Quicken Loans-the one that carry out handle 100 % of your company’s electronic home loan providers. Using Rocket Home loan, borrowers could go through the entire mortgage process-out of preapproval in order to closing-instead of stepping ft inside the a brick-and-mortar place or watching financing administrator privately. Assuming it however wanted a more traditional experience, they may desire manage to get thier mortgage because of Quicken Fund rather.

3. Skyrocket Financial is the first bank to include a completely electronic an internet-based financial sense from start to finish.

Today, of a lot people be prepared to have the ability to deal with the financial and most other profit completely on the web, but one was not usually happening. In reality, Rocket Home loan try a master regarding the electronic financial business, paving the way for other loan companies to check out match. Rather than the standard home loan techniques, Rocket Home loan assured a 100 percent electronic financial feel, that have consumers in a position to complete all parts of the mortgage processes straight from her family. Although individuals now almost predict all the financial technique to feel electronic, the technology making it occurs don’t exist ahead of Rocket Mortgage.

No Response to "Quicken Funds compared to. Rocket Home loan: All you have to Learn"