You can prefer to reduce your home loan rate by buying write off activities. One to write off part is equivalent to step one% of your own amount borrowed. One to discount section can reduce your own 29-seasons Virtual assistant loan price from the 0.125%.

Title Insurance coverage percentage covers brand new homebuyer as well as the mortgage lender from being stored liable for trouble such as outstanding mortgage loans, liens, and you can judge judgments missed from the initially label research shortly after property ownership is actually transmitted.

Credit report fee talks about the cost of performing a credit check for you. It fee can differ based on how much info is expected.

Appraisal fee is actually repaid so you’re able to a good Virtual assistant-acknowledged appraiser to help you estimate the value of the property, make sure the house is disperse-when you look at the able, and you may matches the latest Pros Affairs’ lowest assets standards. Which fee utilizes your location and kind away from assets.

Software Process

An excellent pre-acceptance will provide you with a definite concept of just how much family you can afford. Of the presenting a good pre-approval page, your stand out in order to suppliers and you can real estate agents given that a great severe consumer.

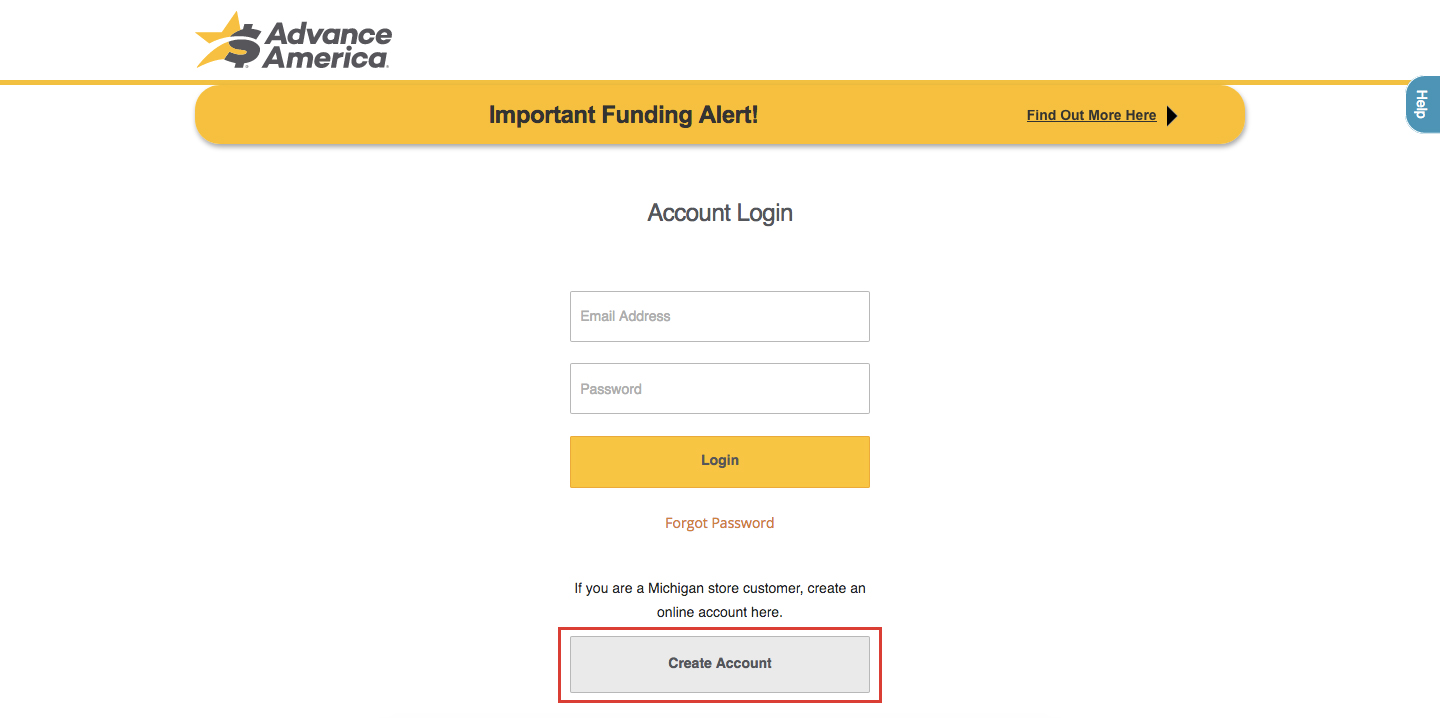

The mortgage affiliate will find out concerning your wished amount borrowed, a position records, military provider, and you may personal protection matter to own a hard credit assessment. In case your cash here are some, you’ll be able to initiate the new pre-recognition techniques while having an internet membership from the My Pros United webpage. Which on the internet platform allows you to publish, indication files digitally, and you can display the loan software process.

A pre-approval are an even more inside-breadth verification of the economic and you may borrowing recommendations. You’ll need to publish an authorities-approved ID, DD 214 having pros, an announcement off services while on energetic obligations, paystubs, 2 years away from W-2s, a recently available bank statement, or any other files as the requested. Once you have got the pre-approval page, you will be ready for household search.

Courtesy Pros United Realty, Pros Joined connects homebuyers with a group of knowledgeable and you may knowledgeable real estate professionals. Such gurus see the means from military homebuyers and will help all of them rating property that fits Virtual assistant finance. Virtual assistant finance are to the purchase of top residencies. You should buy doing a several-tool home with a good Va financing if you intend to live on within the tools. Their possible domestic is going to be who is fit and you may meet up with the minimal assets standards.

After you have discovered your favorite family, you’ll want to put a deal and have it not as much as price. The new package ought to include contingencies so you can withdraw from the pick agreement when the some thing usually do not go sure-enough without infraction off bargain. Using comparables, your agent will allow you to choose a good cost considering economy requirements.

Immediately following you are below bargain, you’re going to be tasked jobs to complete on the Pros Joined Portal. New employment are available as the Accomplish. They are documents you’ll want to submit to the loan administrator. You will have a final check of one’s data files of the an enthusiastic underwriter. Good Virtual assistant-accepted appraiser will additionally measure the property’s market value to make sure a final rates fits definitely along with other similar qualities from the field plus the property match minimal conditions as required by the the new agency.

You’re going to get a closing revelation setting ahead of the last closure. So it document sumount, loan label, rate of interest, and a summary of this new settlement costs. The 3-big date windows gives a debtor time to opinion the mortgage words and you may seek any clarifications until the mortgage is actually signed. If the a service user cannot sit-in a closing, Experts Joined accepts a digital fuel of attorneys.

During the Experts Joined, you could start their pre-qualification techniques online otherwise communicate with a loan associate into the cellular telephone

Which have a beneficial Virtual assistant streamline refinance, you might lower your month-to-month financial pricing. While doing so, a great Virtual assistant IRRL needs reduced documentation given that no borrowing check out this site from the bank underwriting, income confirmation, otherwise appraisal are expected usually. You’re qualified to receive Virtual assistant IRRRL if the:

Loan providers charges an origination fee to pay for administrative costs from the loan. The price tag essentially numbers to at least one% of your own amount borrowed.

No Response to "The latest report primarily includes your credit history, latest stability, and delinquent expense"